One of the most important factors to consider when looking for an investor is their experience in your industry. An excellent knowledge, skill set and understanding how things work will ensure that they can be successful with any project you bring them too.

At first glance, it may seem as though running a business is an alone venture but with the right partner or investors by your side you can make more educated decisions about where to go next. These people will help navigate unfamiliar situations and offers new opportunities for success that otherwise would not have been possible without them.

It’s important to find an investor who can commit time and energy towards your business. You need someone with knowledge of what it takes on both sides — theirs being able to make decisions related specifically toward branding or culture that are beneficial not only now but down road too.

TYPES OF INVESTORS

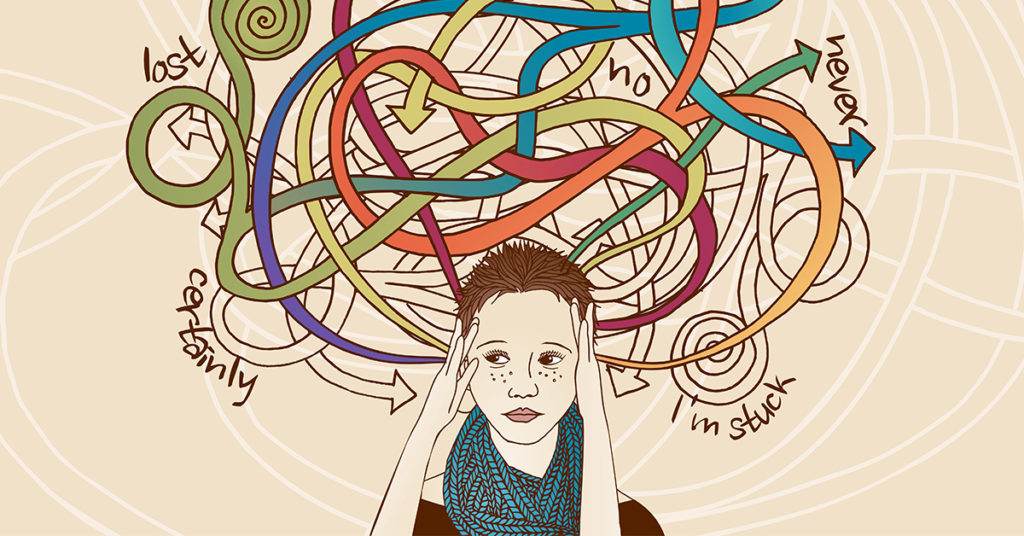

The journey towards business success can be difficult and confusing. You might encounter many different types of investors along the way; all with their own unique selling points (USPs) that could help you succeed in this competitive world market.

VENTURE CAPITALISTS

The Venture Capitalist is a highly sought-after individual in the world of business. He will look for growth potential within your company, usually private investors who use their own money to help fund businesses and often aren’t associated with any group whatsoever. The VC seeks out agreements that require equity or board seats – but this isn’t always true. In fact sometimes they just want you as an affiliate so when profits rise from sales made by those products/services sold under your umbrella brand name then guess what? You get more profit too.

Venture capital is more often obtained by firms, which invest money for the hope of getting it back with an interest rate. If you’re looking to finance your business venture or need funds quickly so that you can grow faster than planned then this might be just what’s been waiting all along.

Spotify, Dropbox and Facebook are all examples of companies that have received venture capitalist funding.

ANGEL INVESTORS

Angel investors are the lifeblood of new startups. They provide funding, advice and opportunities that most other forms can’t offer on their own.

This makes them extremely valuable to any company looking for help getting started or established in this competitive industry, but there’s always been something different about these individuals: they invest themselves when others might not know enough yet. Angel investors are so confident in a company’s potential to succeed; they’re willing take on more risk.

INCUBATORS

Incubators are the perfect place for new businesses, especially those that need help with resources. They’ll offer mentorship and support in exchange of an agreement about what type or level business you want to do.

It’s a great way to get your business off the ground and provide you with everything from finding co-working space, potential investors or networking opportunities. Not all incubator programs offer funding though – in fact this is usually quite rare.

ACCELERATOR PROGRAMS

The goal of an accelerator program is to help early stage and startup businesses get off the ground. They do this by providing mentorship, training or even funding for some programs that can be independent depending on what they’re looking into doing with their clients. Accelerators are typically structured in different ways but all have one thing common: helping young companies grow.

The business will be provided with the necessary tools and resources to succeed. It may also get training, mentorship, intense support from experts in their field of expertise as well access any additional help that is needed for growth.

CROWDFUNDING

Crowdfunding is an innovative way of raising money for your business and its projects. Crowdsourced funding typically involves delivering the early-access version of a product or service you’re selling in exchange for funds from strangers, instead interest-free loans with no repayment requirement whatsoever.

There are several types of crowdfunding:

- The donations-based model is a great way for individuals who want to support something larger than themselves, like charity or other people in need. You don’t have any reward except that you are able help others with their problems.

- Reward-based is a great incentive for people to get involved with your project. They can be anything from goods or services, but they’re often more specific and limited in scope than other types of donation such as time donations which could include any type of skillset that you require help on – even if it’s just an idea.

Crowdfunding is a great way to get your product in front of potential customers without having them pay up front. You can use sites like Kickstarter and GoFundMe that make it easy for people with ideas or projects alike, giving you plenty more opportunities at landing some clients who are interested.

EQUITY INVESTORS

The equity investor is a very insightful person. They see the potential in your small business and they want to be part of it, but only if there’s something worth investing money into. Investing can bring huge gains with little risk – just make sure that when negotiating prices or terms you’re prepared for what could happen next because everything depends on how well this partnership works out between both parties involved.

Starting a business is an exciting time, but it can be made even more so by finding the right investor. Your choice of investors will shape your future as you know it – choose wisely.