The last couple of years have seen a slew in the number SaaS products being used. As it is costly to develop, deploy and market software, securing funding is very important when you’re trying to thrive as an entrepreneur. So how to get SaaS funding?

Prepare for the SaaS Funding

Choose the Startup Funding Options

The funding ecosystem varies, so you have to understand all intricacies before choosing the best option.

Venture Capital

The VC is always on your side. They have deep pockets and can provide credibility for SaaS ventures with their follow-on investments that will make securing them easier in the future.

Sometimes you’ll have to give up some control in order for your business succeeds. This can be difficult, but you will ultimately benefit from the experience and lessons learned. Letting someone else take over certain aspects of running things anyway allow to retain full operationalinence throughout all facets.

Angel Investors

Angel investors are typically more hands on than other types of funding sources. This is good because they can provide you with stability in your business and an environment where people will trust what you’re doing enough to invest their money. But it also means the less oversight over requests from this source – which may turn out expensive.

Accelerators and Incubators

If you’re accepted into an incubator or accelerator program, it’s hard to ignore the potential for your business scale rapidly. They provide mentorship, resources to help you grow your business as well access into various networks of entrepreneurs who can offer advice on how best do so with success.

But there is a back side. In exchange for their services most accelerators require from 2 to 10% equity in your business. And also despite of charged a monthly fee, these programs will cost you.

Revenue Based Financing

There are a lot of pros and cons to choosing the commercial lease over other forms of investment. The first is that once your loan has been paid off, you keep control since there’s no equity exchange in this type deal. The second is future investments don’t generate any returns for pre-revenue startups because they need proof that their company was profitable before being able invest with them. And the last is monthly payments could be an issue if startup businesses struggle financially.

Bootstrapping

Bootstrapping might be the best way to go if you’re looking for full ownership and control of your business.

Highlights. With bootstrapping, there’s an extra incentive build a SaaS product that generates immediate revenue. Full ownership and control remain yours with no mentorship or expertise required when scaling up budgeting gets complex. Funds come directly from vendors instead of being injected into firm, as in other forms startup funding, – this means less risk involved. But if you overuse the limited resources, you might go into debt.

Crowdfunding

Crowdfunding is a great way to raise money quickly and without seeking out investors. Crowdsourcing has been around for many years, but this new strategy takes the best features from each method:

- Accessibility via web platforms with minimal fees or restrictions on investment amount.

- Control over how much you want your campaign funds spent (whether that’s building an awesome product as opposed to giving away free ones).

- Transparency – due its online presence which allows anyone interested enough see what’s happening right now.

It also offers something no other option does – expert guidance when needed most so there are never any surprises along the journey towards success.

Develop SaaS Funding Strategy

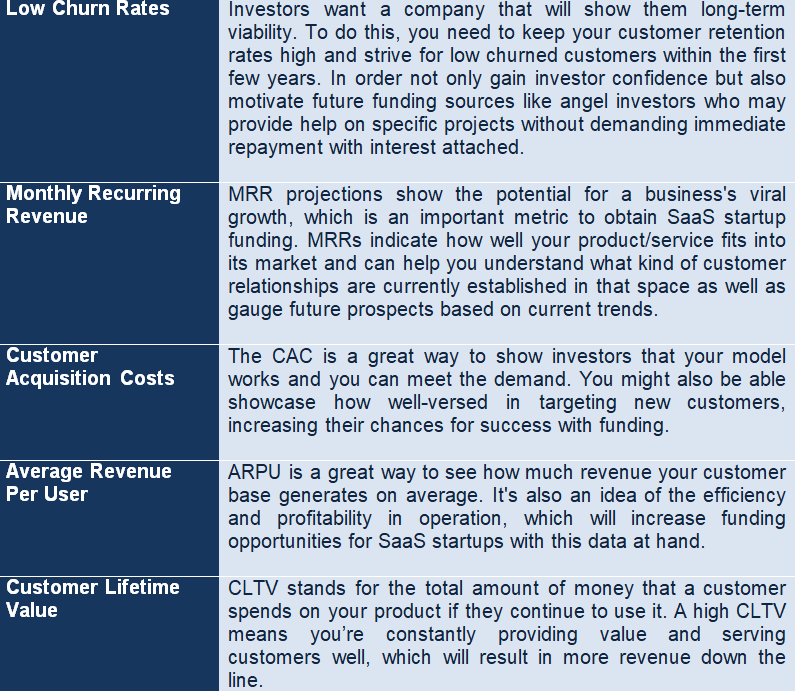

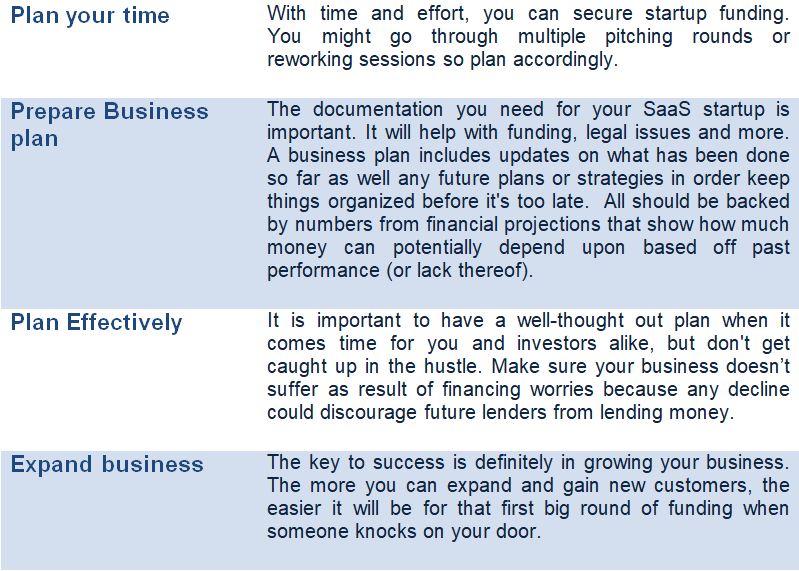

The amount of proposals is overwhelming, and the competition for investment can be fierce. It’s important that you make a strong case or risk losing out on an opportunity to fund your company. This means presenting yourself as someone who will bring value not only now but also into their future business decisions. Here are some metrics to convince the investors.