The boost in funding can make all the difference between whether or not your restaurant is going to be successful. If you don’t have any investors, it’ll take quite some time before anything starts becoming profitable – and even then there’s no guarantee that things won’t get worse before they start getting better. Investors provide an important stability during these early stages by supporting our businesses through thick (or thin) with their cash injection whenever you need them most.

Restaurant financing is not an easy task. There are some of the most popular ways to get funding for your new or existing business.

1. Small Business Administration Loan

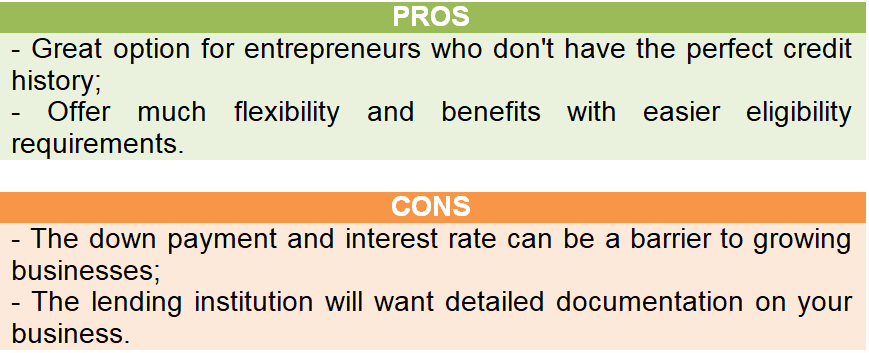

The Small Business Administration loans are designed for small businesses that need help getting started or grown. The guaranteed portion of this funding can be used as collateral if your company becomes unable or unwilling (due directly from financial reasons) pay back what they owe. Otherwise, approval happens quickly at most institutions thanks largely due its partnership agreements with select lenders who offer exceptional services like immediate feedback on possible investments.

There are a few different options for small business loans, but the most common one is an SBA 7(a) loan. This type of funding can be used to cover major expenses related opening your restaurant such as equipment costs and real estate taxes/mortgage payments on property you plan use in generating revenue from food sales.

2. Merchant Cash Advance

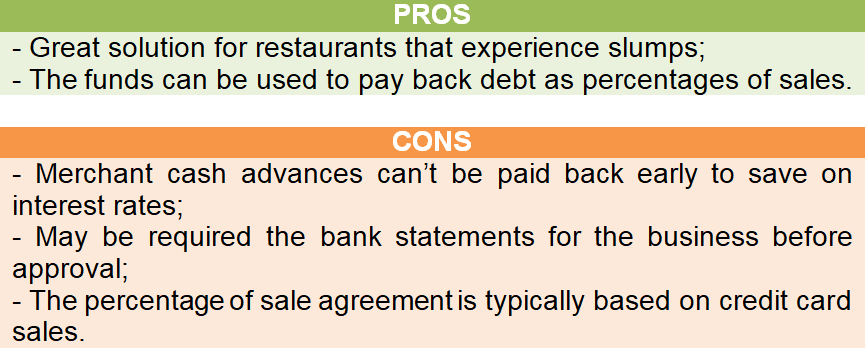

Many restaurants find themselves in need of funds when their credit cards don’t work, or they run out of options. Luckily there’s a solution – merchant cash advances! A company will provide you with an amount greater than what you’re requesting so long as it has been agreed upon beforehand and can be paid back through future sales proceeds once received. The process usually takes less than 1 day from start to finish.

Merchant cash advances can be a great option for funding your restaurant if you do most of your business on credit card transactions.

3. Crowdfunding

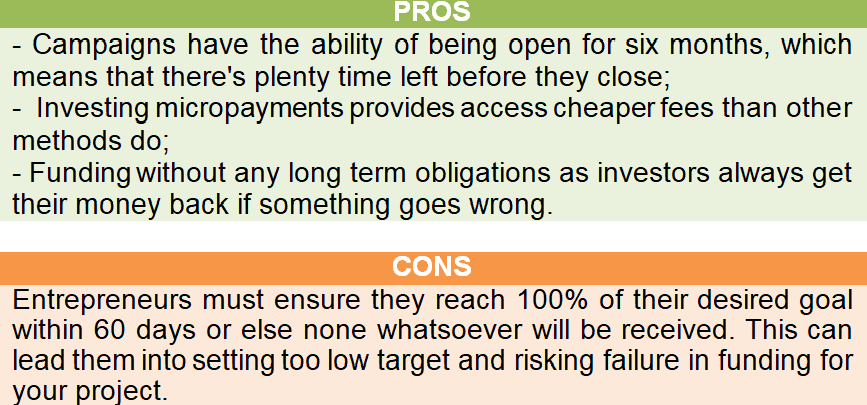

Crowdfunding is an innovative way to recruit the public and fund your idea. Entrepreneurs can use sites like Wefunder or Kickstarter, where they set out their monetary goal that will be met if successful – which rewards those who backed with gifts scaling in value alongside donations made towards it.

Equity crowdfunding has been very successful for the restaurant industry. In fact, 80% of raises are successful on Wefunder because investors get rewarded with financial gains through their payback structure (often a revenue or profit share).

4. Restaurant Investors

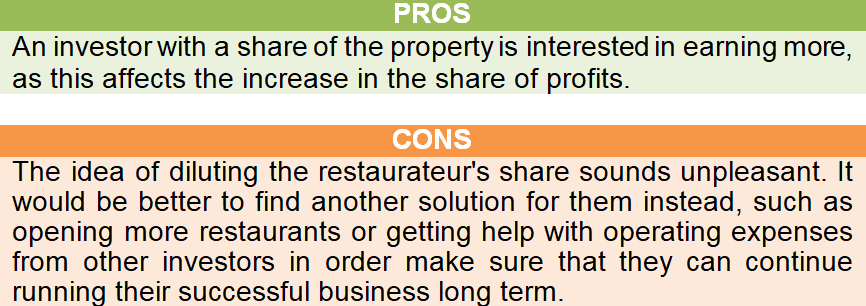

Restaurants are always looking for ways to expand and create new opportunities. One way that they can do this is by seeking out investors who will provide them with financing, in exchange for ownership of your business – especially if you’re not sure what its worth. As an entrepreneur or restaurateur thinking about taking on such a deal then be aware there may come some strings attached: VC firms typically require 10-30% while individual angels want around 20%.

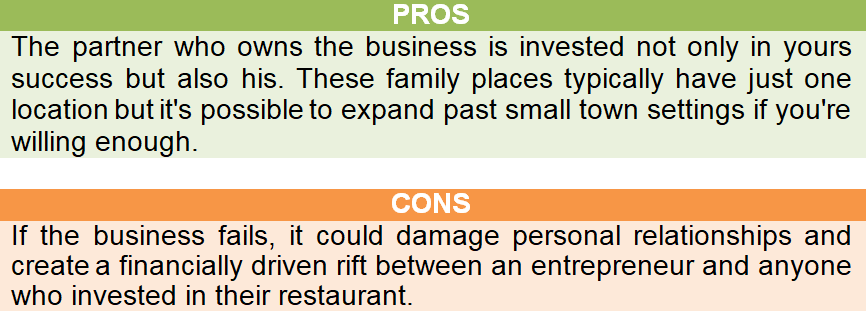

5. Friends and Family

You can reach out and ask your friends, family members or even former coworkers if they would be willing help support the business in some way- whether it’s by lending an ear when things seem rough as well giving financial advice on how best go about setting up.

A route that may appear quite scrappy has been found successful – enlisting trusted colleges & loved ones who want nothing more than success alongside you – and there is no reason why this model cannot succeed too.

Tips for Getting Funding

- The finished business plan will lay out all the necessary information for your investors, so they can visualize their investment and know whether or not it’s worth making.

- Everyone loves a great story, and that’s what you are trying to sell with your pitch. Keep it brief (45 seconds) but make sure the audience understands why they need or want something from you in just one sentence.

- To attract investors, you need to be ready with answers. Think of the questions they may ask and prepare clear complete answers before meeting anyone face-to face or exchanging contracts.