The length of time that you need to raise capital for your startup is a big question all entrepreneurs must get an answer on. While even those who have successfully fundraised pre-seed and seed rounds will be precise in timing follow up activities, keeping the machine going can take some precision from us as well.

PRE-SEED MONEY

The first round of funding can be the most difficult. If you’re an experienced entrepreneur with some successful exits under your belt, then it may not seem as daunting. But out there in all those thousands startups are countless people who need help getting their businesses off ground. Because nobody ever knows what ideas will be really successful.

The truth for entrepreneurs is that ideas are cheap, but execution can be really costly. It takes time and effort to get anything done in this world – time which many people don’t have because they’re too busy running their own businesses or working another job alongside being founders.

It’s no secret that starting a new business can be an exhausting and lonely journey. But don’t let this discourage you. If your idea is something people want, they’ll come around eventually – even without the network or money to get things off of ground floor running quickly.

The main point about any sort-of popular service nowadays: it usually takes at least 2 years before revenue generation begins properly. But if all done right (using multiple sources), then 6 – 12 months should suffice for getting all in order while also finding cash.

New entrepreneurs often think they need a large amount of money to get started, but that’s not always the case. If you’re just starting out and won’t be needing much funds for hard costs like equipment or travel expenses then focus on getting enough so next stage can happen.

MULTIPLE FUNDRAISING ROUNDS

Raising money is a part of starting any business. You typically have to raise enough for your next goal – whether that’s getting closer or further along in the process, it all depends on how much you need at this time and where things are headed with development.

The average startup has their fundraiser once every 12 – 18 months. It can vary depending upon what stage they’re currently invested into. No matter when these events happen – there will always be another milestone waiting just around corner.

In later and larger rounds, the fundraising process often grows a little. You may start out by getting enough money from friends and family to get set up, do more research for your prototype/product or company. It’s need in order to make it successful before moving onto other things like pitching investors at all stages of funding – this includes pre-series A.

There are always those who invest after their initial round has closed but want an active seat on what’s happening with management. These people will have you go back through everything again when this happens until everyone is happy.

Once we hit Series B+ (or greater), businesses need 15–20 months between each influx of capital.

THE FUNDRAISING PROCESS

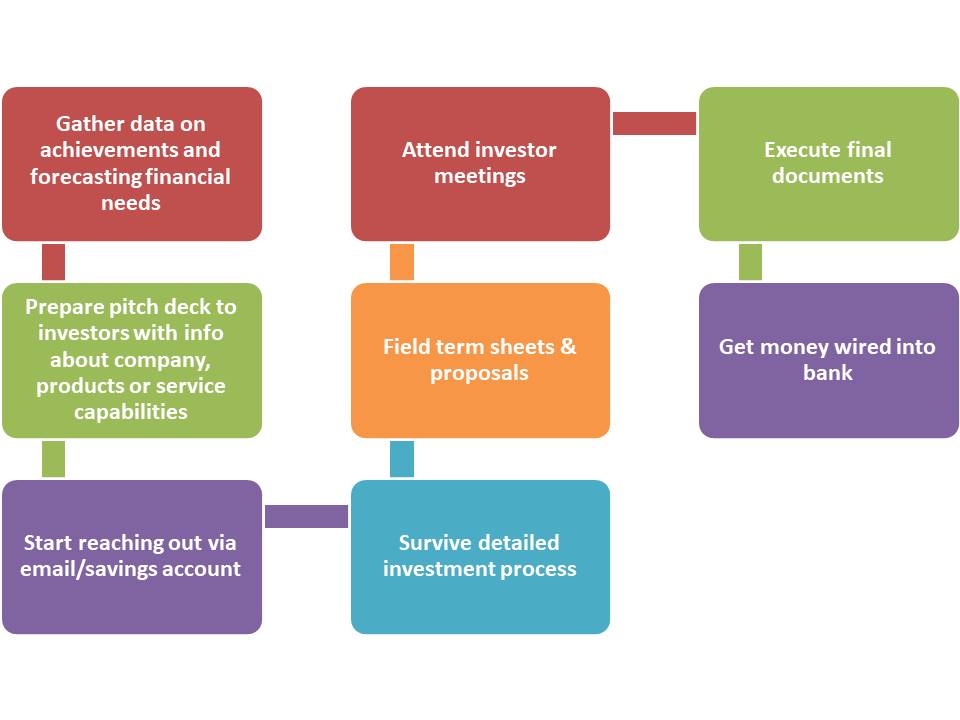

It can take up to a year for an entrepreneur with no funding and just with their own talent. The process isn’t quick but it does get easier as you go along because there are many hoops that need jumping through in order reach this stage where investors will consider investing money into your business.

There’s a lot of work to be done before you even get the chance show off your pitch deck, and that is just on getting people attention. You’ll need relationships with investors who are potential targets for funding as well.

Once you have a good idea and the right team, it can take 90 days to get your startup off of its feet. Many entrepreneurs find themselves stuck in fundraising mode for an extended period time because they don’t have enough capital at each round or “fundraise” as often needed by their business model.

It is important to be as efficient with your time during the fundraising process. It’s easy for this work can feel like an unnecessary burden when you’re not personally invested in it, but remember: if you don’t do your jobs well enough then potential investors will take their money elsewhere.

FACTORS THAT AFFECT THE TIMING OF YOUR FUNDRAISING

- – time of year;

- – the quality and effectiveness of pitch deck;

- – relationship with investors;

- – your performance in investor meetings;

- – the due diligence process;

- – speed of investor moves;

- – the organization accounting records;

- – location (Silicon Valley or New York);

- – capital availability and market trends.

The fundraising process can take a long time, and if you are still on track for closing after six months or one year of effort then there is probably something wrong. It’s possible that your campaign could use some improvements.

When fundraising, it is important to take the time and invest in learning about what you’re trying raise funds for. You should review your pitch deck or consult with experts who can give feedback on how best present yourself so that investors will want to contribute in your company.

Raising capital for a startup can take months, so it is important to have cash in hand and constantly build relationships with both current as well future investors. This way you will not run out of funds before your company has made its mark on the world.