In order to get into real estate development, you should know that it requires outside financing. So before making any major decisions it’s important for developers understand where all this additional money coming from because without financing outside sources won’t be able operates efficiently. You will need equity investments from outside investors and also debt financing. Here are some options for both of these choices.

Crowdfunding For Real Estate

Crowdfunding has been a great way for real estate developers to find capital that they would not have access too otherwise. The challenge with crowdfunding, however is the regulations surrounding its application in different types of investments are complicated and confusing. Especially when it comes down deciding who your target investors should be.

Crowdfunding is a great way to raise money for your project without having direct connections with investors as laws previously required. You can find potential capital through online platforms or by outreach on your website. But the selection criteria tend towards very narrow parameters which mean you may not qualify even if you have experience and an excellent idea.

Crowdfunding has different regulations depending who the target crowdfunding audience are – so it’s complicated in part because there isn’t one clear set of rules across all states/countries.

Equity Financing for Real Estate

When the investor contributes money to purchase an asset, they are typically investing in a single-purpose company that has been set up solely for this purpose. In exchange for their financial backing and ownership of shares within the business itself, investors will receive compensation based on how well it performs over time.

The primary role of developer will be to manage the execution of asset’ business plan. Investors will have agreement with SPE that describes how their investment will be returned to them.

In order to get funding for their projects, developers will often turn to investors who offer them returns in the form of 8%. The income this generates comes from net operating revenue which can be rents or sales. Investors also share percentage profits that come with asset sale. If it’s an equity investment then they’re passively involved without much real management responsibility. The risk falls mainly on behalf of those offering up money so there might not always have been any at all. But some see this as more risky than debt.

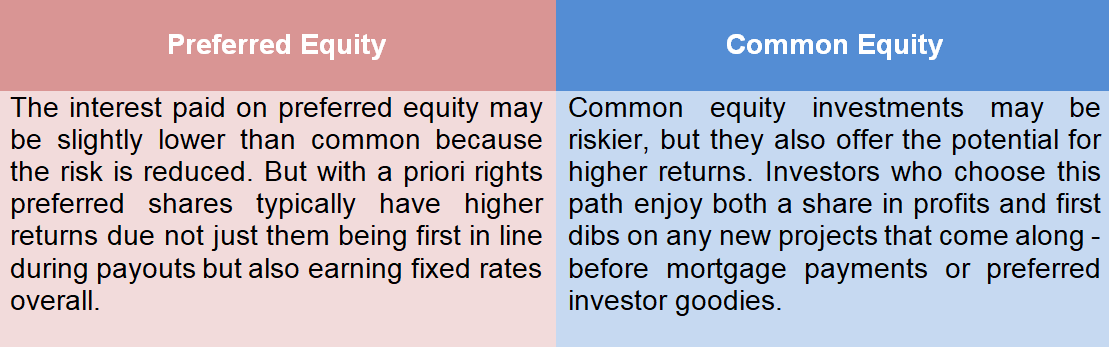

Equity investments come in many forms, with two of the most common being preferred and common stock. Developers can choose to issue either type depending on their needs for funding a project or what investors will want at any given time.

Debt Financing For Real Estate

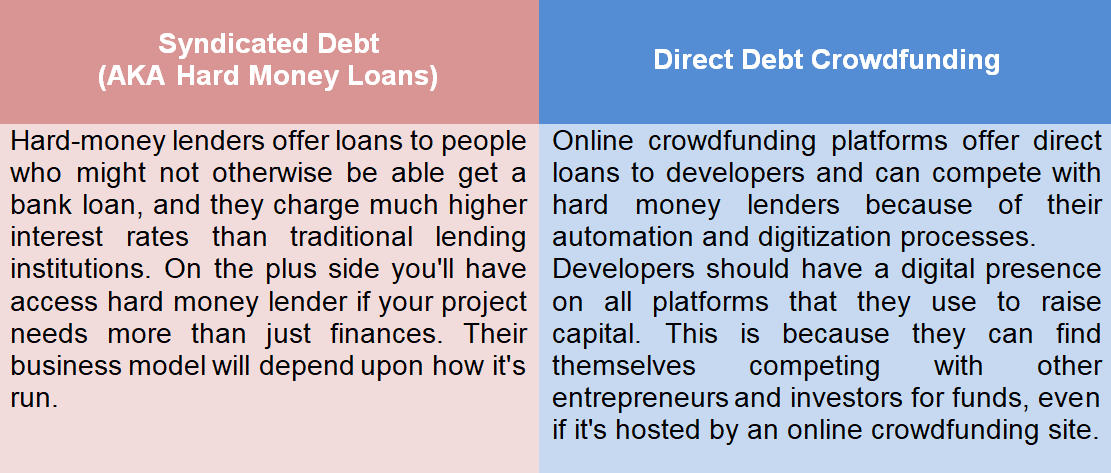

The debt financing model in the new crowdfunding industry has been a great help for developers. The amount of capital available to them is larger and they don’t need equity from project owners. This allows more people from many different backgrounds participate as investors by providing loans instead all while still maintaining accessibility on both ends.

Two ways of Debt crowdfunding

For developers, there are a lot of benefits in using debt financing. The only difference will be where your loan comes from and how much it takes to apply for one. But all options are secured by properties being developed so investors know their investment is secure no matter what happens during construction or after completion. In addition, interest payments on these types mortgages happen before dividends go out – which could make them more attractive than equity crowdfunding.

Financing Real Estate with Loans

Loans for real estate development can come from a variety of sources, including banks and wealthy individuals. One way to finance these projects is through syndicated loans which were mentioned above.

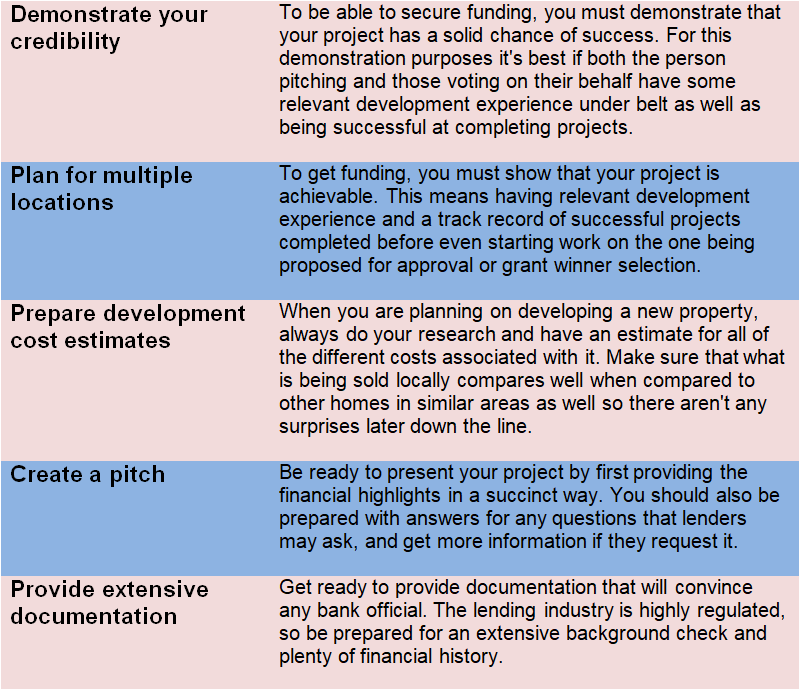

Basic process applying for financing from any source