Startups are the driving force behind economic growth and innovation. New products created by startups indicate ambitious entrepreneurs with creative ideas, which is why they’re so important for society as a whole.

Startup success stories often go viral on social media – but not all of them will succeed in business or create successful companies. Here are some interesting statistics about these startups and innovative individuals below.

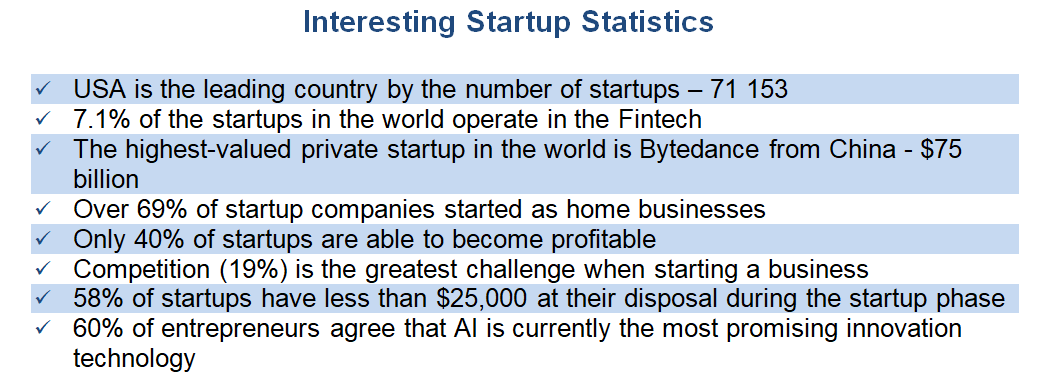

1. Global industry distribution of Startups.

Check out the top 10 startup industries according to this chart. Fintech takes first place – 7.1%, followed by Life Sciences and Healthcare with 6.8%, Artificial Intelligence at 5%. There isn’t completely accurate data about what each industry does but it’s clear that modern startups tend towards internet-based technologies right now – and these days.

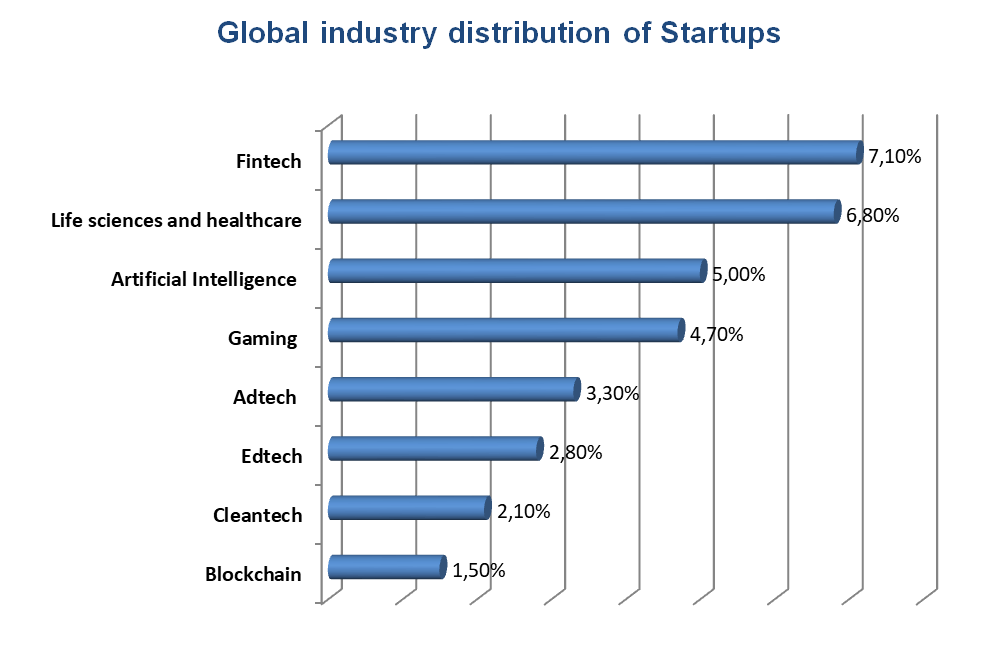

2. Top countries by numbers of startups.

The United States has the largest number of startups in absolute terms, with 71 153 new business ventures started up. India comes second by way behind it at 13 125 while thirdly there’s Great Britain which houses 6 220 entrepreneurial endeavors. To give some perspective on this matter: US outnumbers all other countries combined.

3. The most valuable unicorn company in the world.

The Chinese company ByteDance, which also owns TikTok and is valued at $350 billion+, currently has more than 600 Unicorn companies around the world. However most are located in China or America; only 20% can be found elsewhere such as Europe for instance with UberEats (headquartered England). These globalization trends show how important it is not just to start up but rather where you do so too because what might work locally may fail miserably if tried on another continent.

4. Location of Unicorn companies.

The United States is home to more unicorns (50%) than any other country in the world, with China coming close at 25%. India and Britain round out our top five for this measure – each accounting for 5% or 20 companies total.

5. The value of eCommerce sales.

The value of eCommerce sales globally is around $3.5 trillion, with rapid growth expected in the future. The eCommerce industry is one of the most popular sectors for new startups, especially as companies striving to offer online financial services have been booming since PSD2 was introduced. Another focus area in which these budding entrepreneurs look toward with great interest puppose multiple industries: cybersecurity, fintech, food tech. With over $16 billion invested last year alone EdTech organizations are becoming increasingly common place across America.

6. The highest-valued private startup in the world.

It is a Bytedance (Toutiao), from China, worth around $75 billion. As ANT Financial continues to grow and become more valuable, it’s no surprise that other Fintech companies around the world are catching up. China’s Didi Chuxing is second with a $56 billion valuation while US-based startup Blerara wing brings in third place at $36 billion – not too far behind their Asian counterparts. Fourth spot goes SpaceX whose price tag tops $33 billion against AFIgent Spacecraft Company.

7. How many startup companies started as home businesses?

The answer – over 69% started as home businesses. Home-based businesses are more popular than ever. With government regulations and an increasing cost of living, starting a company from home has become less daunting for many entrepreneurs who want to keep their overhead low while also working on projects they love.

8. How many startups fail?

The statistics are alarming. Out of 10 startups, 9 don’t make it and 20% fall apart after a year; 30 percent close within two years (50%) while only 50 per cent survive longer than five (10%). The primary reason being lack in ability to offer products/services for target markets which leads many companies not generating enough interest from them.

9. Startup capital level.

Money matters for startups. 58% of startups have less than $25,000 at their disposal during the startup phase. 33% of the companies surveyed said they had less than $10,000 in capital to get started and execute on their business plan. This is a huge issue that will surely doom more promising businesses before they even take off.

10. Rating of profitable startups.

Only 40% of startups are able to become profitable. The data collected shows that there are many different factors involved in starting up a business. Legal issues, logistics and organizational problems all have their own role to play when it comes time for the startup process but can be overcome with enough planning beforehand or during difficult moments if necessary. 30% of startups have a higher chance of losing profit, while the remaining 30% will simply lose money from the beginning.

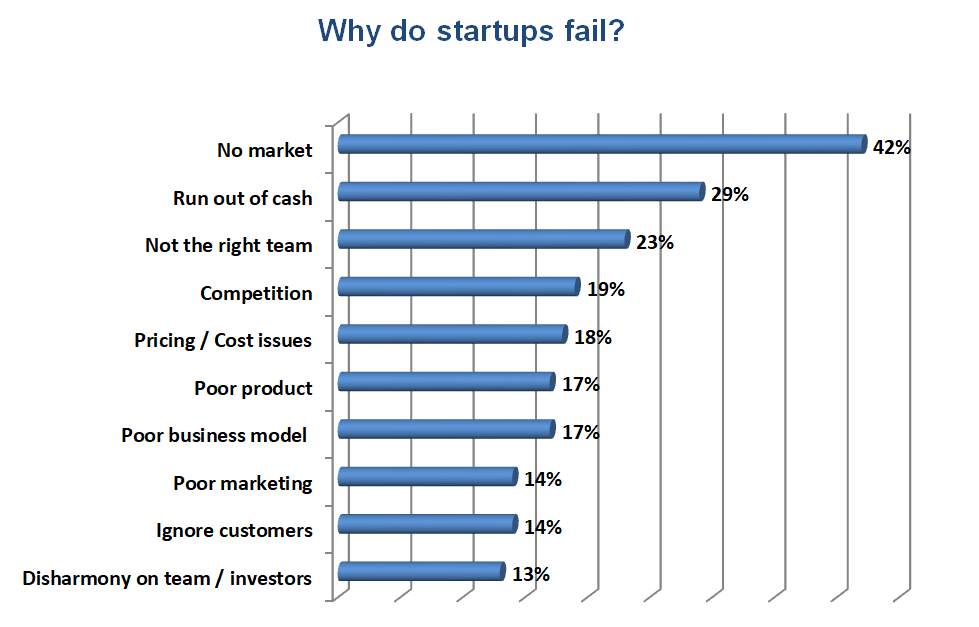

11. Why do startups fail?

The highest number (42%) of startups fail because they misread the current market demand. The harsh reality is that most startups don’t make it past their first few years in operation. Some reasons for closure include poor team organization (23%), being pushed out by the competition (19%) and having cost issues (18%).

12. Cost disposal during the startup period.

It’s a general rule-of thumb that most startups have $10,000 to invest in their business. However costs can vary depending on what kind of venture you’re starting and how much additional investment will be needed for future growth.

13. Personal savings during the development process.

In order to grow your startup, you will likely need investors who are willing and able take a risk on new businesses. However this is not always an easy task as most people want their investments early so they can get back what was invested into them later with interest rates or growth potentials. Almost ¾ of startups used personal savings during the development process.

14. Annual revenue for sustainability.

The goal for most startups is to reach $50k at least in annual revenue. Building this takes time, so finding investors becomes one of the top priorities when starting up a business because they need financing before making any profits and paying off loans or other obligations such as payroll expenses which can’t wait.

15. Startup valuation for last 10 years.

The startup market has been steadily growing for years now, and it’s only getting more serious with each passing day. It was 2010 when seed valuation grew by 11% per year on average; since then Series B funding grew 15%, while series A went up 16%. This means that investors are willing to pay higher prices than ever before.

16. Location of Micro Venture Capital funds.

The vast majority of startups are located in North America, with 58% (or nearly two-thirds) belonging to Micro Venture Capital funds. Asia accounts for 19%, while Europe and the restive world has 11%. There’s not much difference when it comes down to Non Micro Venture capital – with the only major difference being Asia with 22%.

17. Venture capital investments.

Venture capital can be one of the most reliable investments, with an extremely high return. However it is only available to startups that have long term potential for growth and venture capitalists don’t invest often in these types companies because they know there isn’t much chance at success. Only a tiny number of startups (0.05%) secure venture capital investments.

18. Long-term goals.

In a survey of company leaders, 50% said they expect their business to be acquired in the long-term. 18% plan on going public at some point while 15 percent don’t have any intentions for an IPO or staying private forever. And only 9 percent were not prepared either way yet.

19. The tendency of the market development.

The Global Green Technology and Sustainability Market is expected to reach $28.9 billion by 2024, with a 27% growth rate over the next four years. In terms of technology innovation in this space there’s been huge advances recently including blockchain which may provide innovative solutions for carbon footprint management applications.

20. Tendency of technology development.

60% of entrepreneurs agree the most exciting new innovation technology is Artificial Intelligence. Not only does it have the potential for growth in the sphere of autonomous transportation and big data, but entrepreneurs also think that AI will be a more promising future development than any other type of machine or gadget on offer right now.